Considerations To Know About woodbridge bankruptcy attorney

I stimulate you to look around and I am absolutely sure you'll find the knowledge valuable. While you are Prepared just give us a call or electronic mail. We've been listed here that will help you.

Also, if a lender provides a lien on an asset for instance a car or home, the lien stays even when the debt is discharged. That's, the filer doesn’t really need to pay out the debt, however the lender can seize the asset that secured the financial loan.

Based on FICO, the corporation powering the most widely utilized credit history scoring types, that is determined by how superior (or small) your credit score score was to start with. Anyone with "an exceedingly significant FICO Rating could be expecting a big drop within their rating. Alternatively, someone with a lot of unfavorable things previously mentioned on their credit history report may possibly only see a modest drop in their rating," FICO suggests.

But if you do contain the economic means to pay, settling the debt could preserve you a substantial sum of money, as well as the headache of a trial.

Why? The trustee ought to shell out a lot of these nondischargeable debts before paying out nearly anything to other creditors, which reduces the balance owed.

When I first satisfied Richard, I realized instantly I'd designed your best option. I really am grateful for Richard’s research and exertions. Bryan J. View see page entire evaluate right here

Some Chapter seven filers accomplish that “pro se”—without the need of an attorney’s assist. This will save learn this here now on lawyer payments, but nonexperts will make issues critical adequate for a court docket to deny their request for cover.

At the end of the repayment time period, any remaining debts, with specified exceptions, might be discharged from the courtroom, that means which the debtor is below no obligation to pay them.

If your gross cash flow is simply too superior, you can use the means test calculation variety to subtract allowed expenses from a income. If you don't visite site have more than enough to pay for an affordable volume to creditors immediately after completing the calculations, you can expect to qualify for Chapter seven.

Another way a creditor may get a judgment is by submitting a lawsuit, but the debtor ignores the accommodate. The courtroom will then enter a default judgment (generally, an computerized gain for the creditor) towards the debtor.

In your response, It is vital to elevate all feasible defenses towards the lawsuit, for instance the statute of limitations has run or the her response products you been given ended up defective.

A Chapter thirteen bankruptcy is often a authorized Device that permits debtors to produce and adhere to a sensible personal debt payment plan. Whenever you file for bankruptcy underneath possibly Chapter 13 or beneath Chapter seven, an purchase for aid – an “automated stay” – goes into influence.

Even though Chapter 7 is about receiving out from less than debts, filers sometimes don’t want to discharge some debts. A filer should want to repay a car or truck rather then Use a lender repossess it. In these conditions, the filer can reaffirm the financial debt, agreeing to pay it off Although it could be discharged.

You have selected rights and protections when currently fairfax bankruptcy attorney being contacted by a debt collector who's subject matter for the FDCPA. A financial debt collector can’t use the specter of a lawsuit to gather a debt if they don't plan to file a lawsuit.

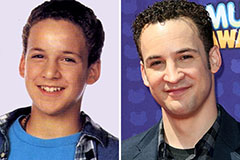

Ben Savage Then & Now!

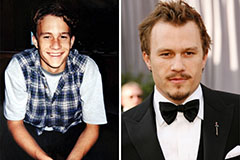

Ben Savage Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Marla Sokoloff Then & Now!

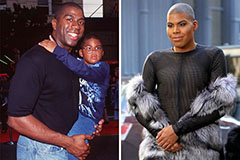

Marla Sokoloff Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!